Nevada is known as the Silver State, it has the 7th largest area among US states and it represents a significant touristic destination, visitors being attracted mostly by the vivid Las Vegas, the home of gambling activities. There are numerous foreign investors who have successful businesses in this field, but for a better understanding of how companies are registered in Nevada, we invite you to explore the general guide to company incorporation in Nevada. Likewise, you can ask for support from our team of company formation specialists in Nevada.

| Quick Facts | |

|---|---|

| Types of structures available for business in Nevada |

– limited liability company, – sole proprietorship, – partnership, – corporation |

|

Institution in charge for company registration in Nevada |

Secretary of the State of Nevada, the Business Division |

|

Content of Articles of Association |

– type of business structure and operations, – general and internal rules, – situations in which the company can be closed |

| Formalities for company formation in Nevada |

– business name reservation, – appointing a representative agent, – drafting company documents, – issuance of EIN (Employer Identification Number) |

| Documents for starting a business in Nevada |

– Articles of Association, – Operating Agreement, – Certificate of Incorporation |

| Tax registration required (YES/NO) |

Yes |

| Support for licenses and permits (YES/NO) |

Yes |

| Local business bank account |

Not mandatory, but recommended |

| Insurance for company formation in Nevada |

Recommended |

| Financial planning (YES/NO) | Yes |

| Accounting requirements |

– balance sheet, – bookkeeping, – payroll, – annual financial statements, – specific financial plans |

| Corporate tax for LLCs in Nevada |

Not imposed |

| Sales tax in Nevada |

4.6% |

| Reasons to choose our services |

– simple formalities and incorporation, – experience of our agents, – affordable prices for services offered |

| Free case evaluation |

Solutions offered by our specialists after an evaluation of the situation presented |

Table of Contents

Forming an LLC in Nevada

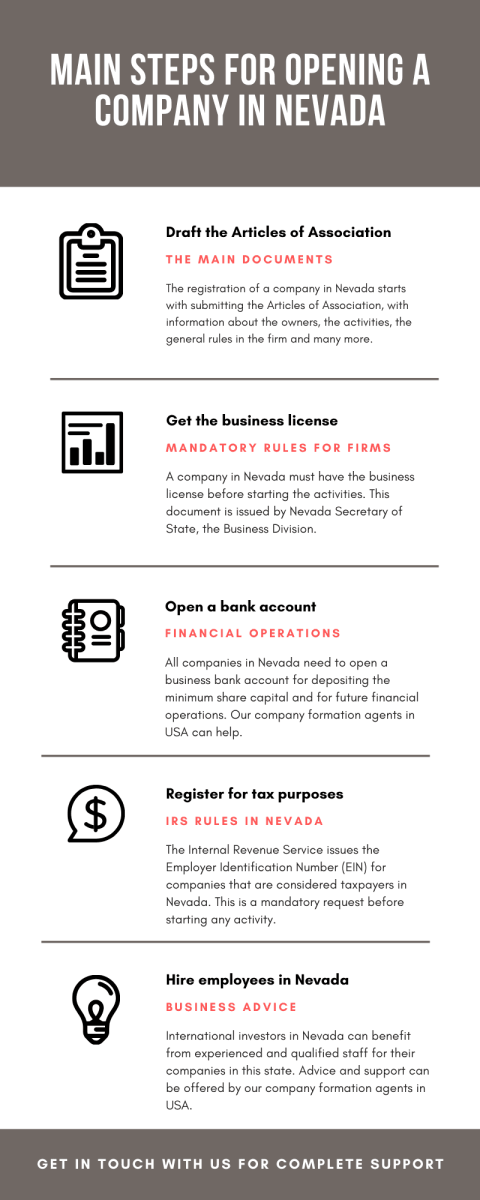

Foreign investors in USA usually focus on easy incorporation and fast operations on the market. If you want to open a company in USA and especially in Nevada, a limited liability company may be the proper business form for your future activities. The registration of such a company starts at the Secretary of the State of Nevada, particularly the Business Division, where the Articles of Association are submitted. These documents must contain complete information about the owners of the business, the board of directors, the activities, the official address of the company, and the name of the registered agent. This person is officially in charge of the company’s documents and can act on behalf of the company. It is good to know that a company in Nevada may be represented by another enterprise, or even better, our team of consultants in USA can offer support in this sense.

We offer specialized services for those who want to start a company in USA and expand their portfolios in one of the American states. We can properly manage the paperwork and we can also explain the formalities implicated. There are a few types of companies you can select from, each of them with a specific taxation. We suggest you get in touch with our team of company formation representatives and discover the right type of service for you.

Apply for the EIN of the company in Nevada

From a taxation point of view, each company must respect the conditions imposed regarding the Employer Identification Number (EIN) or the federal tax as it is known. The Internal Service Revenue (IRS) issues the tax IDs for companies in Nevada through local offices. The EIN is also necessary when opening a business bank account in this state.

The sales tax in Nevada

The sales tax in Nevada is generally set at 8.25% and 4.6% especially for the city of Las Vegas. Foreign entrepreneurs may benefit from tax exemptions when starting a business in USA, particularly in Nevada because there is no state income tax and no inheritance tax. Local tax offices may impose different city taxes one should consider.

Special licenses and permits in Nevada

From the beginning, we mention that only five states in USA impose a business license at the time of company incorporation, Nevada being one of them. There are three types of licenses, such as:

- city-based;

- county-based;

- industry-based.

Please bear in mind that our company formation agents in USA can guide foreigners in obtaining the needed business license for their operations. If you would like to start a business in Nevada, feel free to discuss it with our agents.

Accounting firm for companies in Nevada

If you want to register a company in USA, including in Nevada, it is best to hire an accounting firm and keep track of the financial operations of the company. Bookkeeping, payroll, audits, and financial annual statements are among accounting matters linked to any company in Nevada, regardless of the business field.

Virtual office services for your company in Nevada

Foreign investors who do not want to establish a traditional office for their activities in Nevada can benefit from virtual office services which are subject to low expenses. A notable business address with a registered office, mail collection and forwarding, incoming and outgoing faxes, a dedicated business number, and voice mail on request are only a few of the virtual office services a foreigner can have in Nevada. Please bear in mind that our team of consultants can offer in-depth information related to this, taking into consideration the necessities of your firm. Forming a corporation in Nevada enters our attention.

Economy overview in Nevada

The entertainment and the gambling sectors are Nevada’s main sources of revenue, due to the high number of tourists registered each year in this state. Besides these, the economy in Nevada relies on mining (especially gold and silver), food processing, machinery and equipment, printing and publishing, agriculture, and farming. Carson City is the capital of Nevada and cities like Las Vegas (the most prolific one), Reno, Sparks, Henderson, North Las Vegas or Boulder City are only a few of the top destinations for business in this state. Here are a few statistics and figures that highlight the economy in USA and reasons to do business here:

- In 2019, USA registered nearly USD 9,465 billion in terms of total FDI stock.

- The 2020 Doing Business report ranked USA 6th out of 190 countries in the world in terms of ease of doing business.

- UK, Canada, Germany, Japan, France, and Ireland are the key investors in USA. Most of the investments from these countries are absorbed by sectors like manufacturing, insurance, and financial activities.

FAQ about company formation in Nevada

1. Can I open an LLC in Nevada?

The limited liability company represents the most popular business structure available in USA. You can register an LLC in Nevada if you respect the conditions imposed by the legislation.

2. Where do I register an LLC in Nevada?

Companies in Nevada can be registered with the Business Division of the Secretary of the State of Nevada. The formalities implicated for forming a corporation or an LLC in Nevada can be managed by our agents in USA.

3. Do I need an EIN for my company in Nevada?

Yes, the EIN is the Employer Identification Number or the tax identification code that shows the business pays the imposed taxes. The registration for taxation purposes is a process that can be overseen by one of our specialists in company formation in USA.

4. How can I open a bank account for a business in Nevada?

A business in Nevada needs a bank account for future financial operations. A copy of the company’s main documents will be solicited by the bank, plus other formalities that can be explained by our agents. There is no need to come in person for opening a bank account, as our specialists can act on your behalf with a power of attorney.

5. Do I need special licenses and permits for a business in Nevada?

Yes, depending on the activities you want to establish in Nevada, your business might need a local, federal, or state license. There are no complexities for obtaining a business license, however, you should discuss with our experts the formalities implicated.

6. Is an operating agreement required for a company in Nevada?

There is no obligation for having an operating agreement for a business in Nevada. Even so, it is recommended to have an internal document like this and make sure the business operations and general rules are covered.

7. Can I ask for accounting services in Nevada?

Yes, you can hire the services of an accounting firm in USA if you start a business in Nevada. It is a great choice to externalize the accounting services instead of creating a whole department to deal with such aspects. Get in touch with our specialists and see how they can help you from this point of view.

8. Do I need an insurance for my company in Nevada?

Yes, it is suggested to consider an insurance policy for your newly formed business in Nevada. Such insurance protects your company against potential risks that might occur.

9. How can I promote my company in Nevada?

Once the business is started in Nevada, you can consider creating a website to present the products and services available for your potential clients. Promoting a business online is probably the best way to develop your activities and attract as many clients as possible.

10. Is Nevada a good place to start a business?

Yes, Nevada is quite appealing from a business point of view. Many foreign companies already activate in sectors like IT, manufacturing, engineering, automotive, energy, and agriculture, to give a few examples. If you would like to know more about forming a corporation in Nevada, feel free to discuss with our specialists in company formation in USA.

Choose our USA specialists for business formation

Foreign entrepreneurs who want to invest in the US and develop their activities with the help of various companies are advised to use the services of specialists in company formation. Legislation on business formation in the United States must be understood from the beginning, and an expert in the field can provide the necessary support in this direction. The clients who collaborate with us can rely from the very beginning on professionalism, dedication, efficiency, and transparency. Our team of professionals works closely with relevant institutions dealing with company registration, licensing, and many other aspects.

We sustain our clients from the very beginning and help them register a business in USA in accordance with the legislation in force. If you want to start a business in Nevada and you need support in company formation, please do not hesitate to contact our team of company formation representatives in USA.